COME AND LEARN FOREX FUNDAMENTALS THE FREAK WAY.

1. Fundamental analysis is the digesting economic data to essentially determine whether a currency is undervalued or overvalued.

2. Once a view has been formed based on the fundamentals of a respective currency, this can then be compared across the currency market.

3. Conducting forex fundamental analysis is not as difficult and as boring as you may think. We have made this all very much fun and informative, set to largely contribute towards your development.

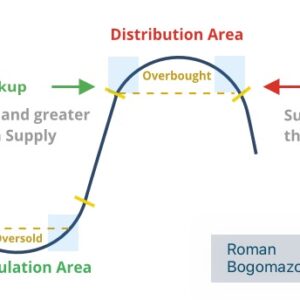

Over the years of testing many strategies to see what works most effectively with trading fundamentals, Supply and Demand has proven its efficiency.

It is not to sy this will be the holy grail when trading fundamentals, however if properly executed with a solid risk management plan, success can be found.

Freak Forex Fundamentals Course Curriculum

What’s Inside?

- GDP (Gross Domestic Product) (4:05)

- Retail Sales (3:24)

- Inflation (5:50)

- Labour Market (2:37)

- Central Banks (7:15)

- Hawks & Doves (3:02)

- Central Banks & Monetary Policy Divergence (4:46)

- Building A Picture With Central Bank Information (7:20)

- Central Bank Action Example (2:00)

- Central Bank Rate Decision Example – FOMC Cut Rates (4:55)

- Global Economic Slowdown (3:15)

- Correlating Economies and Currencies (3:11)

- Commodity Linked Currencies (2:30)

- Bond Market Correlation To Currency Market (4:24)

- Geopolitical Events (4:20)

- Geopolitical Impact On Market (Examples) (3:53)

- Geopolitical Market Reaction Example – Trump Announces Tariffs On China (9:12)

- Safe-haven Currencies (3:52)

- Safe-haven Currencies Market Example (3:57)

- Stock Market – Currency Correlation (3:08)

- Market Flash Crash (5:12)

- Economic Calendar (4:15)

Supply & Demand Trading

- Introduction To Supply & Demand

- 1. Finding Demand (5:43)

- 2. Finding Supply (3:10)

- 3. Time Frames (3:32)

- 4. Economic Event Example 1 (4:36)

- 5. Economic Event Example 2 (3:56)

![[HOT] BTA Certified Blockchain Developer – Hyperledger Fabric](https://www.coursesgo.com/wp-content/uploads/2020/11/BTA-Certified-Blockchain-Developer-–-Hyperledger-Fabric-300x300.jpg)